“The interval fund structure is the most disruptive way to democratize access to the private markets, particularly late-stage venture capital,” Christian Munafo, Chief Investment Officer of Liberty Street Advisors/Shares Post 100 Fund says.

IMPORTANT RISKS AND DISCLOSURES

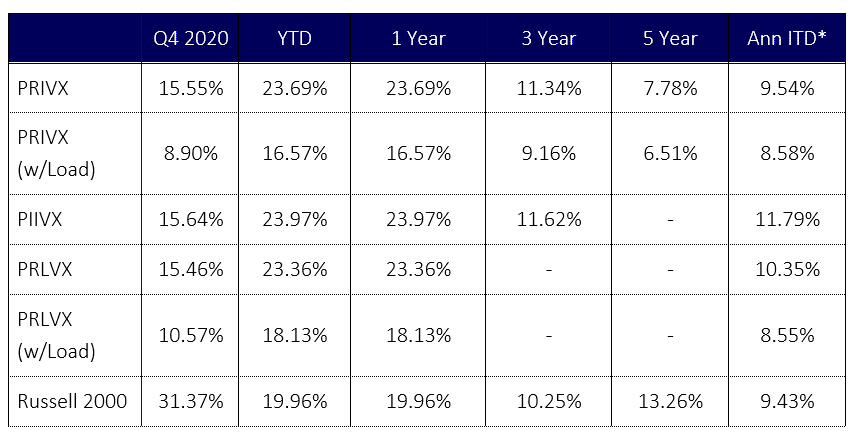

PERFORMANCE AS OF 12/31/20

*Class A inception date 3/25/14, Class I inception date 11/17/17 Class L inception date 5/11/18.

Returns vary per share class. Performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. For performance as of the most recent month-end, please call 1-800-834-8707. Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Fund’s total expenses are 3.32%, 3.57%, and 3.07% for the Class A, L, and I shares respectively. The Fund’s advisor has contractually agreed to waive fees and/or reimburse expenses such that total expenses do not exceed 2.50%, 2.75%, and 2.25% for the Class A, L, and I shares respectively. The agreement with the Advisor is in place through December 9, 2022. Net expenses are applicable to investors. Performance results with load reflect the deduction of the 5.75% maximum front end sales charge for Class A Shares and 4.25% for the Class L Shares.

AS OF DECEMBER 9TH, 2020, LIBERTY STREET ADVISORS, INC. REPLACED SP INVESTMENTS MANAGEMENT, LLC (“SPIM”) AS THE ADVISER TO THE FUND. AS OF APRIL 30, 2021, THE FUND CHANGED ITS NAME FROM THE “SHARESPOST 100 FUND” TO “THE PRIVATE SHARES FUND.” THE FUND’S PORTFOLIO MANAGERS HAVE NOT CHANGED.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus with this and other information about The Private Shares Fund (the “Fund”), please download here. Read the prospectus carefully before investing.

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund. The Fund’s quarterly repurchase program allows for up to 5% of the Fund’s net assets to be redeemed each quarter. Due to transfer restrictions and the illiquid nature of the Fund’s investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by Liberty Street Advisors, Inc. (the “Investment Adviser”) pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees, as set forth in the prospectus. As a consequence, the value of the securities, and therefore the Fund’s Net Asset Value (NAV), may vary. There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund is a “non-diversified” investment company, and as such, the Fund may invest a greater percentage of its assets in the securities of a single issuer than investment companies that are “diversified.” The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund’s expense ratio. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund.

A venture capitalist (VC) is a private equity investor that provides capital to companies exhibiting high growth potential in exchange for an equity stake. Private Equity (PE) refers to capital investment made into companies that are not publicly traded. J Curve is a chart where the line plotted falls at the beginning and rises gradually to a point higher than the starting point, forming the shape of the letter J. It reflects a phenomenon in which a period of unfavorable returns is followed by a period of gradual recovery that rises to a higher point than the starting point. The phenomenon applies in private equity funds.

The Russell 2000 is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index.

It is not possible to invest in an index.

References to other mutual funds should not be considered an offer to buy or sell these securities

The Fund may not be suitable for all investors. We encourage you to consult with appropriate financial professionals before considering an investment in the Fund.

The Fund is distributed by Foreside Fund Services, LLC.